Silver prices (XAGUSD) have started catching up to gold’s top performance, and there is potential for further explosive moves.

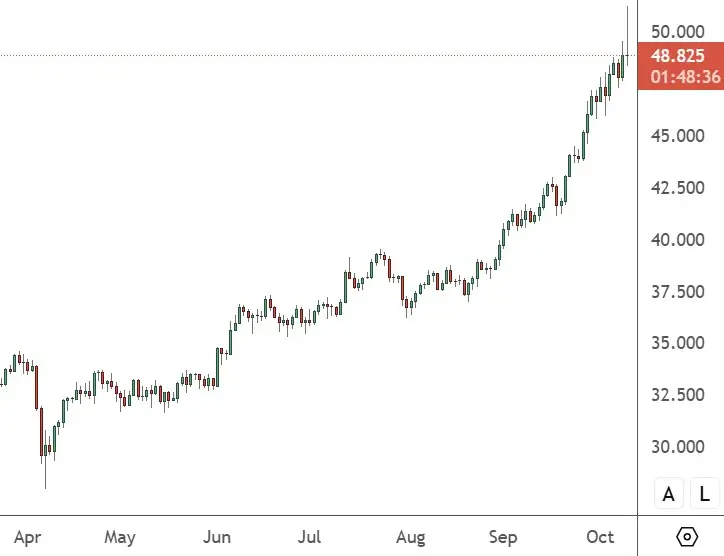

XAGUSD – Daily Chart

XAGUSD has surged from levels below $40.00 at the start of September for a rapid move to $50.00. Although we have seen selling arrive here, investors should remain on guard for a breakout to higher levels.

This is now the strongest run in decades for silver as the sleeping side of precious metals woke up. Silver has been a store of wealth for short-term, or retail investors and can often lag smart money moves in gold by months.

The world is now talking about precious metals after gold surged to $4,000 per ounce. Strong investment demand from ETFs, alongside retail investors pouring money into silver and persistent shortages in the spot market, are driving silver higher.

Silver has now jumped by 69% this year, outpacing the performance of gold in recent sessions.

Long-time gold and silver bull Peter Schiff believes silver could hit $100 with higher inflation. While the U.S. consumer price index slowed to 2.9% in August, Schiff warned that inflation was not over. He said a return to 9% was possible, which could push safe-haven assets like gold and silver higher.

Insiders are also concerned about the recent squeeze as trading activity surged on the London Bullion Market Association (LBMA) and COMEX. Institutional and retail investors are pouring into metals as a haven, with the market “jittery” about structural problems if demand continues.

A surge in silver could also hamper companies involved in sectors such as solar and electric vehicles, which rely on silver for manufacturing components. Metals and mining stocks have gotten a boost from the recent surge in both gold and silver.