The EURAUD exchange rate has comments from the Reserve Bank of Australia and the European Central Bank ahead.

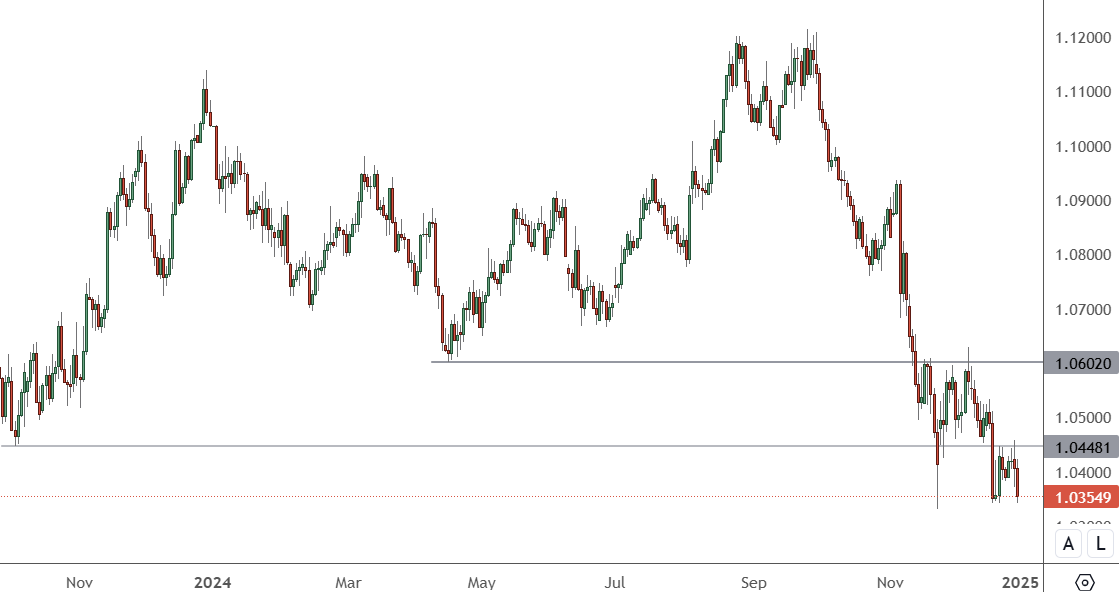

EURAUD – Daily Chart

The EUR/AUD has been falling after resistance arrived this year at the 1.8100 level. A range is being set, but the low may not be in yet.

The Reserve Bank of Australia will host its press conference at 11:30 am HKT, and that could set the trend for the week ahead.

The bank’s latest monetary comments will come days after the country’s Senators grilled Governor Michelle Bullock about inflation. Bullock has admitted that her economists’ inflation targets have not been accurately predicted, while Senators asked when the economic “experiments” would end.

Bullock said the RBA had been more focused on creating a steady unemployment rate than beating inflation. Headline inflation has been outside of the bank’s target band for the last three years.

“I think we’ve got a situation where we’ve got an unemployment rate of 4.3 per cent and we’ve got an inflation rate at 3.2 at the moment, admittedly and forecast to come within the band, so I think the strategy still is alive,” she said.

Australia’s economy grew at the fastest pace in two years through September, boosted by business, government and consumer spending. Markets and business owners are expecting that the next move in interest rates could be up, rather than down.

Data from the ABS showed real gross domestic product (GDP) in the third quarter climbed by 2.1% from the same time a year ago. That was the fastest growth since mid-2023 and exceeded the bank’s 2% forecast.

European Central Bank policy member Joachim Nagel will also speak at 3pm HKT and he has recently said that inflation is practically at the bank’s target and is not expected to fluctuate. The current trend is for Aussie dollar growth driven by higher rates, while the ECB appears done with its rate-cut moves. That could push the EUR v AUD lower and we may not have seen the support level yet.

The European economy has been another reason the Aussie is being bought, as the auto sector struggles with Trump’s tariffs and manufacturing remains weak. European carmakers send 25% of their vehicles to the U.S., but higher costs have depleted exports.